Tax me later: A fun (yes, really) guide to taxes in Germany

Welcome to Taxland!

So… you’ve moved to Germany. Congrats! Here’s your welcome gift: taxes. 🎁

Taxes can seem like a drag, but they’re the backbone of society — and the reason amenities such as free education and public healthcare exist in Germany. That’s all well and good, but wrapping your brain around German tax rules — in German, no less — can feel like trying to solve a Rubik’s Cube blindfolded.

But don’t despair! To save your time, money and sanity, we’ve created this guide for expats and tax-anxious humans alike. So, basically for everyone. You are absolutely, 100% not alone in this spreadsheet-scented journey.

Our qualifications, you may ask? Oh, merely a humble PhD in Tax Mistakes. We’ve fumbled, so you don’t have to!

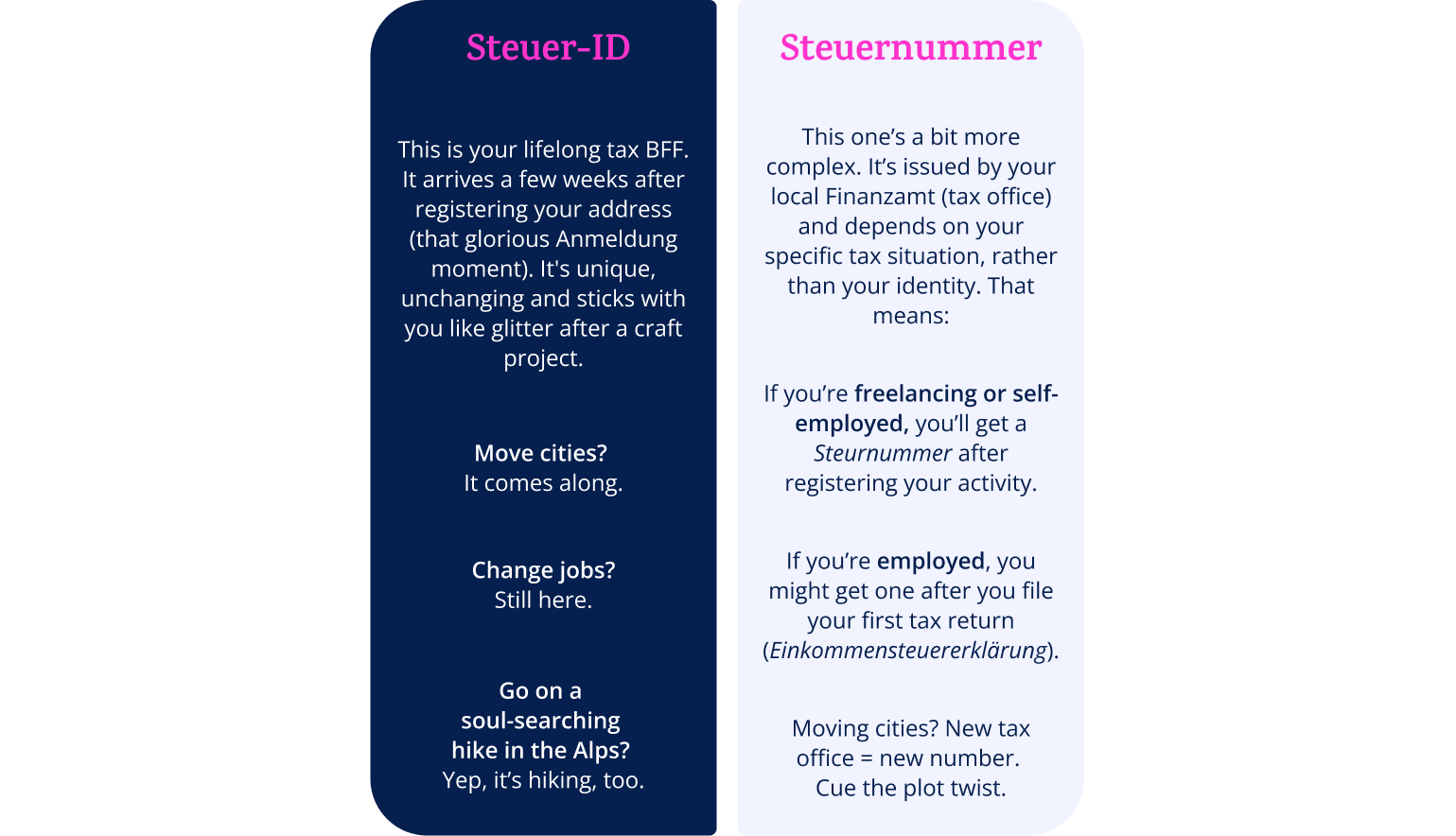

- ‘Steuer-ID’ vs. ‘Steuernummer’: Same, but totally different

- Germany’s progressive tax system: More brackets than IKEA

- Tax words you should definitely know

- What the heck is on my payslip?!

- Tax classes (‘Steuerklassen’): Which one are you in?

- Do I have to file a tax return?

- Students, say ‘Hallo’ to the tax office

- Freelancers and side hustlers: Welcome to the grown-up table

- Unexpected wins: Weird things you can deduct

- Deadlines, fines and other thrilling plot twists

- Tools that make this less painful

‘Steuer-ID’ vs. ‘Steuernummer’: Same, but totally different

Let’s talk tax numbers. Yes numbers. There are two of them. Welcome to the German bureaucracy multiverse. But fear not — this sitcom has just two starring roles:

So, when to use which?

- Steuer-ID: In general, you’ll use this number for official forms and documents such as job contracts, health insurance and child benefits.

- Steuernummer: Bust this one out when dealing directly with your local tax office. It’s especially helpful for declarations, invoices and all aspects of self-employed life.

Because nothing says “I love bureaucracy” like giving everyone a code… or two.

Germany’s progressive tax system: More brackets than IKEA

Germany’s income tax (Einkommensteuer) is based on a progressive system of taxation, which essentially means the more you earn, the more you pay. But here’s the sweet part: you only pay the higher rate on the income within that tier — not on your entire income. So, if you’ve earned a certain amount, you’ll pay a smaller percentage of the first tier and a gradually larger percentage of the second tier, the third tier and so on.

Think of it like a wedding cake. You get the basic layer for free, but the fancier frosting comes at a price.

In 2025, income up to €12,084 is tax-free (the Grundfreibetrag). The tax rate then climbs gradually from 14% to 42%, before peaking at 45%. Note that these numbers are subject to adjustment in future tax years.

What’s the solidarity surcharge (and why are you still paying for something from the 1990s?)

Ah, yes, the Solidaritätszuschlag, also affectionately known as Soli. It was introduced in the early 1990s to help finance German reunification and take some burden off citizens from the former East Germany, who generally had lower incomes than their Western counterparts. Big historical moments aren’t cheap.

Here’s the scoop:

- Since 2021, most employees don’t pay the Solidaritätszuschlag on their income anymore.

- But! If you earn a lot — or if you make money from capital gains and investment income — you’ll still be deducted Soli in the form of a tidy 5.5% on top of the flat 25% tax. You’ll usually see it listed on your Lohnsteuerbescheinigung (tax certificate) or your bank’s annual summary.

Church tax: A holy surprise on your payslip (and how to escape it)

Did you tick Catholic, Protestant or Jewish during your Anmeldung without thinking too hard about it? Surprise! You’re now helping fund church activities, regardless of how often you attend (or don't).

Church tax (Kirchensteuer) is a real thing in Germany, and it’s automatically deducted from your income tax. Current rates are:

- 8% if you live in Bavaria or Baden-Württemberg

- 9% in the rest of Germany

To opt out of paying Kirchensteur in future years, you’ll need to do a Kirchenaustritt (official church deregistration). This involves:

- An appointment (probably at a Standesamt or district court)

- Paperwork (naturally)

- A small fee (typically €20–€60).

And, no, you can’t just ghost the church.

Some people still decide to pay this tax in deference to tradition or personal belief. Others happily pay it to help fund the various services provided by religious institutions in Germany, which range from weddings to social care. But if you’d rather redirect those funds elsewhere… now you know the (holy) way out.

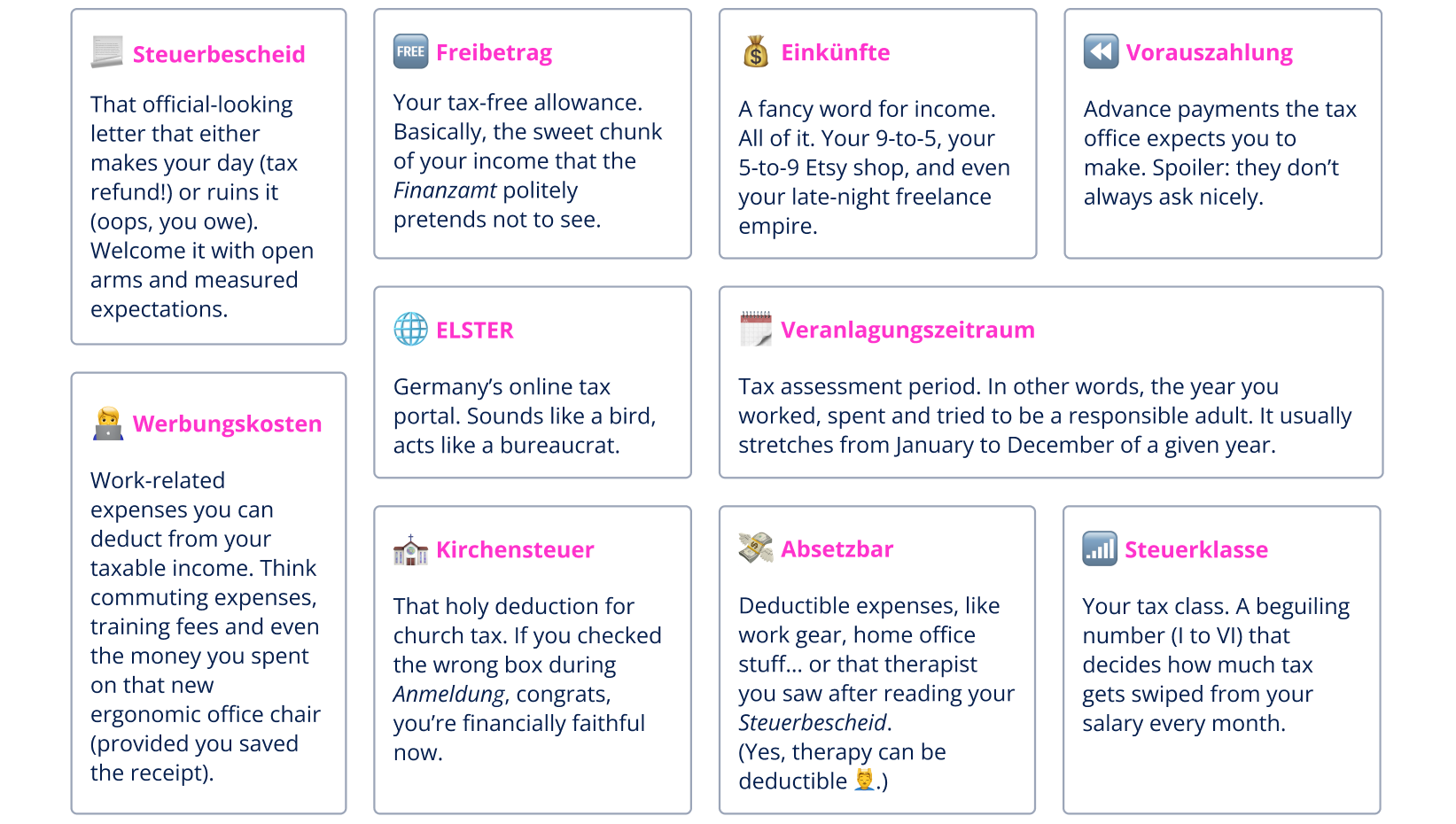

Tax words you should definitely know

Because nothing says “I’ve got my life together” like casually dropping Freibetrag into conversation.

Here’s your cheat sheet:

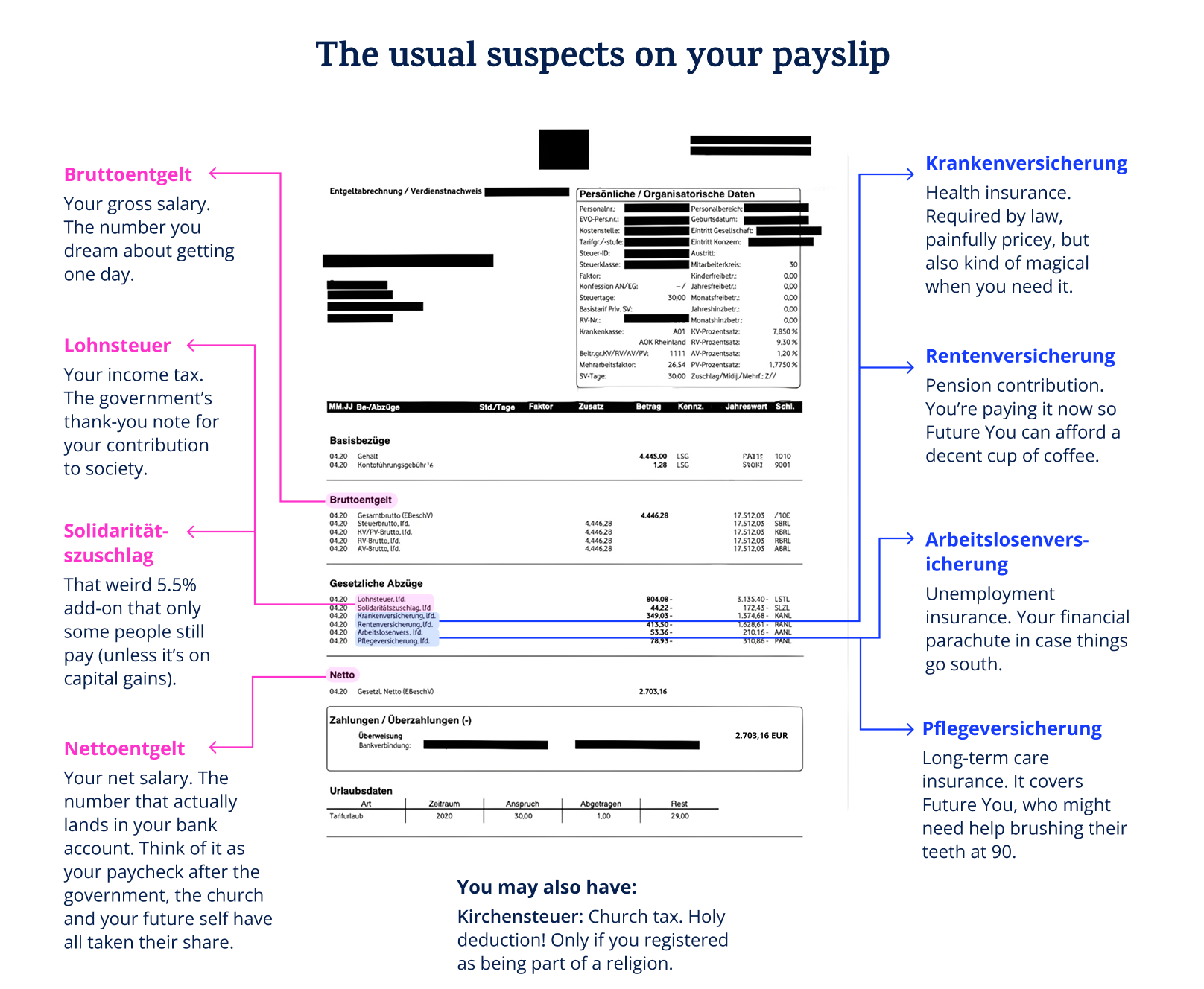

What the heck is on my payslip?!

First payslip? Congrats, you’re officially confused. Don’t panic. Let’s decode the chaos:

How to know if your company is underpaying you

Feeling like your Nettoentgelt is suspiciously Nett-Oh-no? You might be onto something. While mistakes are rare, it’s always smart to double-check your payslip. Keep an eye out for:

- Incorrect tax class (Steuerklasse): If you're classified incorrectly, you might be overpaying (or underpaying, which means the tax office will come knocking later).

- Missing allowances (Freibeträge): Didn’t register your tax-free allowance correctly? You’re basically tipping the tax office. Generous, but unnecessary.

- Underreported hours or wages: Compare your contract to your payslip. Are the hours and rates matching up? If not, it’s time to channel your inner spreadsheet warrior and have a friendly-but-firm chat with HR.

- Weird deductions: Anything labelled Sonstiges (miscellaneous) that’s bigger than a daily pretzel budget deserves a second look.

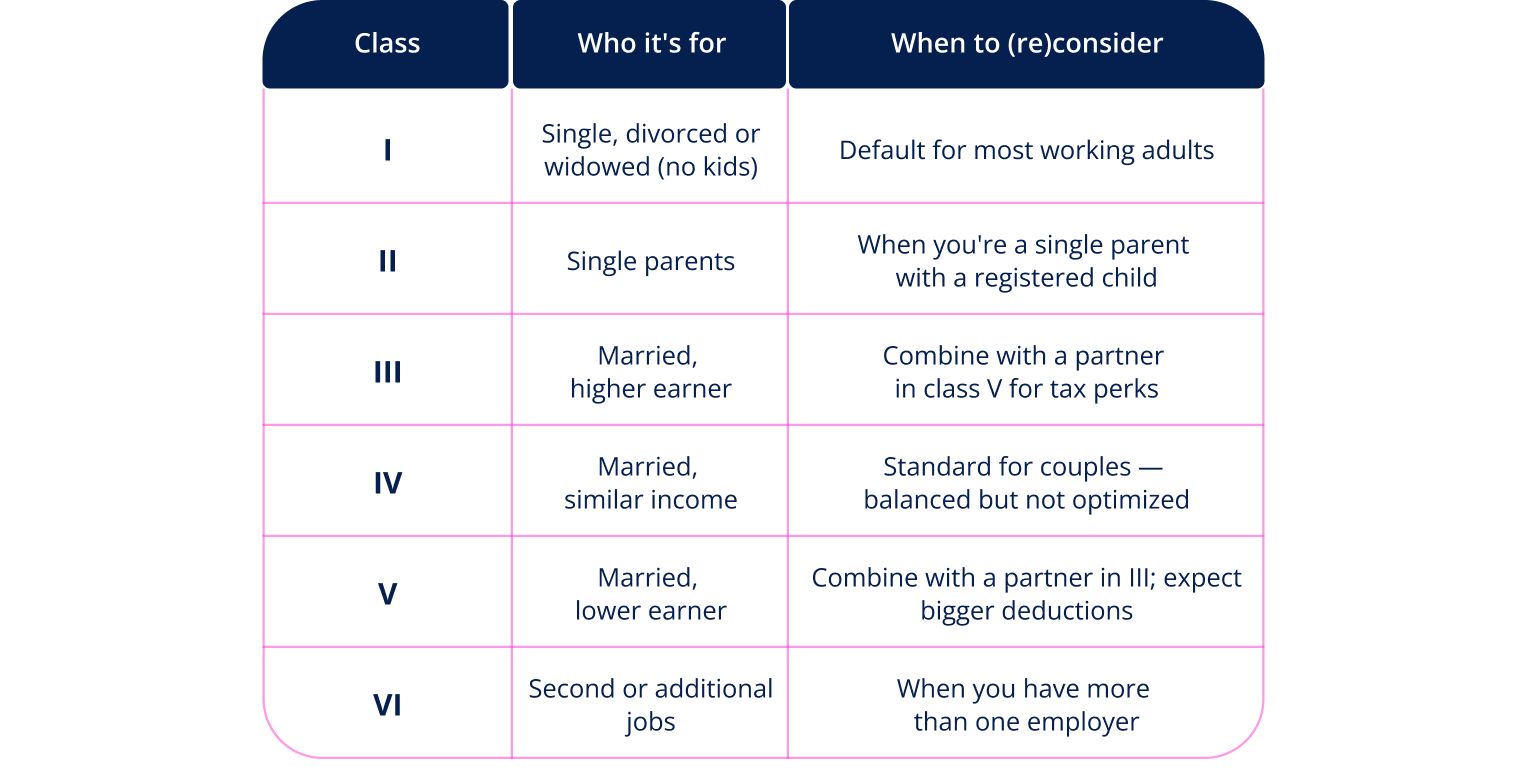

Tax classes (‘Steuerklassen’): Which one are you in?

Welcome to the weird world of Steuerklassen, where your love life, job status and part-time hustle determine how much tax you pay.

Germany has six tax classes. Picking the right one can make a big difference on your payslip.

Most folks default to Class I when single, but if you're married or have multiple jobs, things get interesting. Some combos — like the infamous Class III + V for couples — can unlock savings... if the income split is juuust right.

Here’s a table that helps you make sense of it all:

Do I have to file a tax return?

The Einkommensteuererklärung. One word, 25 letters, and a surprisingly decent shot at getting money back. Filing a tax return in Germany isn’t always mandatory, but it’s often worth it. So don’t miss out, even if you don’t have to hand one in.

So, who has to file?

You're legally required to submit a tax return if:

- You have multiple income sources (e.g., a second job or rental income)

- You got Kurzarbeitergeld (short-time work allowance)

- You received Elterngeld (parental allowance)

- You're married and have tax class combo III/V

- The tax office sent you a “friendly reminder” (i.e., a mandatory letter in terrifyingly official German)

And who should file?

Honestly? Almost everyone who wants their hard-earned money back. Especially if:

- You changed jobs during the year

- You had a long commute or unreimbursed work expenses

- You worked part-time or only part of the year

- Your employer didn’t apply a tax-free allowance (Freibetrag)

Students, say ‘Hallo’ to the tax office

Yes, even if you're living off instant noodles and student discounts, the Finanzamt might still want a word. Taxes and student life? Yep, it’s a thing.

When do students owe tax in Germany?

First things first: not all student income is taxable. Here’s a breakdown:

- Mini-jobs (up to €538/month) – Usually tax-free. Small job, small fuss.

- Internships – Taxable if they’re paid and not part of your curriculum.

- Working student contracts (Werkstudent) – Taxes kick in if your earnings exceed the yearly tax-free threshold.

- HiWi jobs (student assistants) – Usually taxable, depending on how much you earn.

For 2025, income up to €12,096 is tax-free. Above that? Welcome to adulthood. We have income tax.

What about social security?

These aren’t taxes, but they still nibble at your pay:

- In Werkstudent jobs, you still pay pension contributions. There’s no escaping that.

- For mini-jobs, you can opt out of pension insurance, but only if you apply for the exemption.

Claim those deductions (yes, even your laptop counts)

Good news: the tax office loves receipts (almost as much as Germans love recycling). You can deduct things like:

- Laptops, headphones, textbooks, office chairs and other office supplies

- Commuting costs and train tickets

- Tuition fees — especially if you’re at a private university or completing a Master’s degree

- Study-related tech (printer ink, online subscriptions, WiFi bills — if reasonably justified)

First-degree vs. second-degree studies:

- Bachelor's degree: “special expenses” → limited deduction

- Master’s or second degree: “income-related costs” → higher deduction, bigger refund potential

Why filing voluntarily is a smart student move

Even if you earned little in terms of income, a voluntary tax return (Antragsveranlagung) can pay off. Here’s why:

- You might reclaim overpaid taxes.

- You can declare study-related expenses now and carry them forward as losses into your future job (Verlustvortrag = a fancy way to say "future refund credit").

- You can file retroactively for up to four years. That's four years of refunds waiting for you.

Freelancers and side hustlers: Welcome to the grown-up table

So… you sell art on Etsy, tutor English on weekends and teach yoga for cash? Congrats! You’re technically a business now.

When do you need a ‘Steuernummer’? (Spoiler: Now)

It doesn’t matter how much you’re making. If you're earning money outside of a standard job, you need to register with the Finanzamt.

You’ll need a Steuernummer (tax number) if you’re any of the following:

- Freelancer (Freiberufler): writers, designers, consultants, tutors, etc.

- Small business owner (Gewerbetreibende): online sellers, crafters, shop owners, etc.

Even if it’s “just a little side gig,” you can’t send legal invoices without one.

Here’s how to get it:

👉 Fill out the Fragebogen zur steuerlichen Erfassung (German for “Tell us everything about your business”). You can do this online via ELSTER.

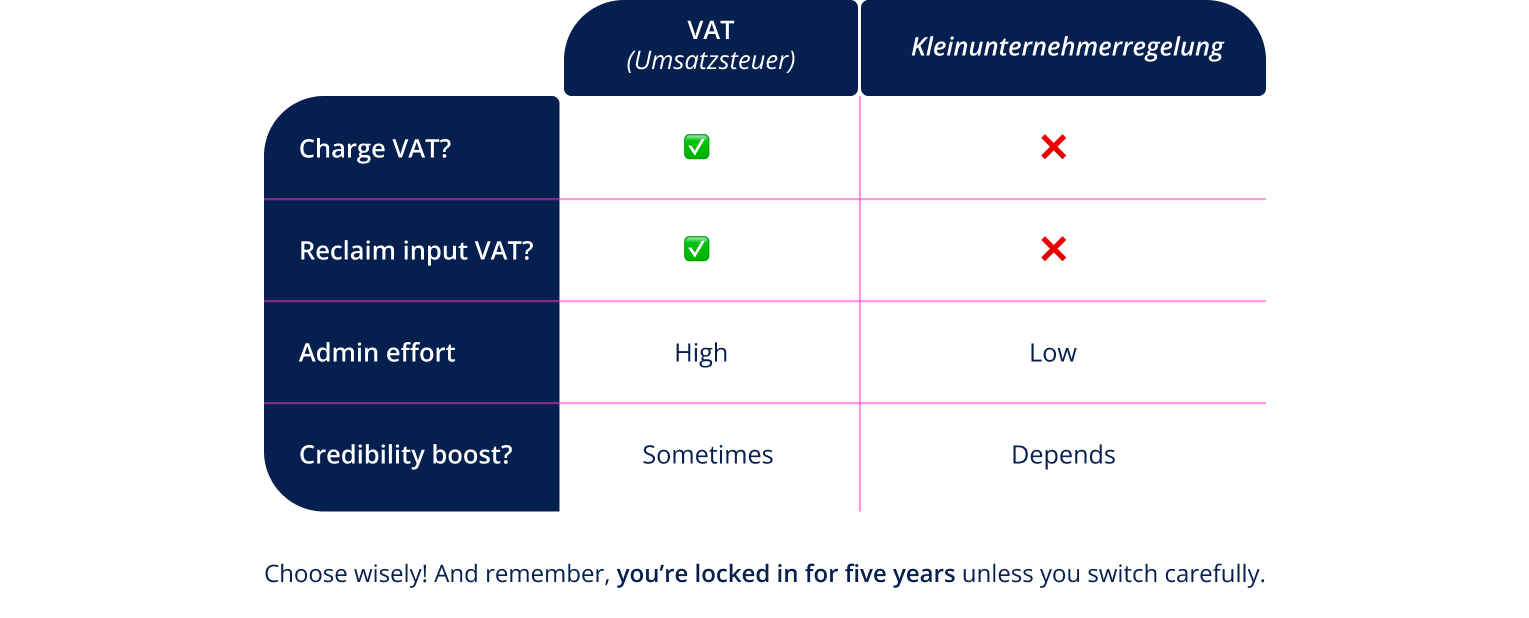

VAT (‘Umsatzsteuer’): The ‘Do I charge it?’ game

Ah, Umsatzsteuer (VAT). So simple on paper, so wild in practice. If you earn more than €22,000 per year, you must add 19% VAT to your invoices. Below that? You can apply for Kleinunternehmerregelung (more on that delightfully long word below.).

Charging VAT means:

- You add it to your invoices

- You pay it to the Finanzamt

- You can deduct input VAT (Vorsteuer) from business expenses like laptops, software or rent

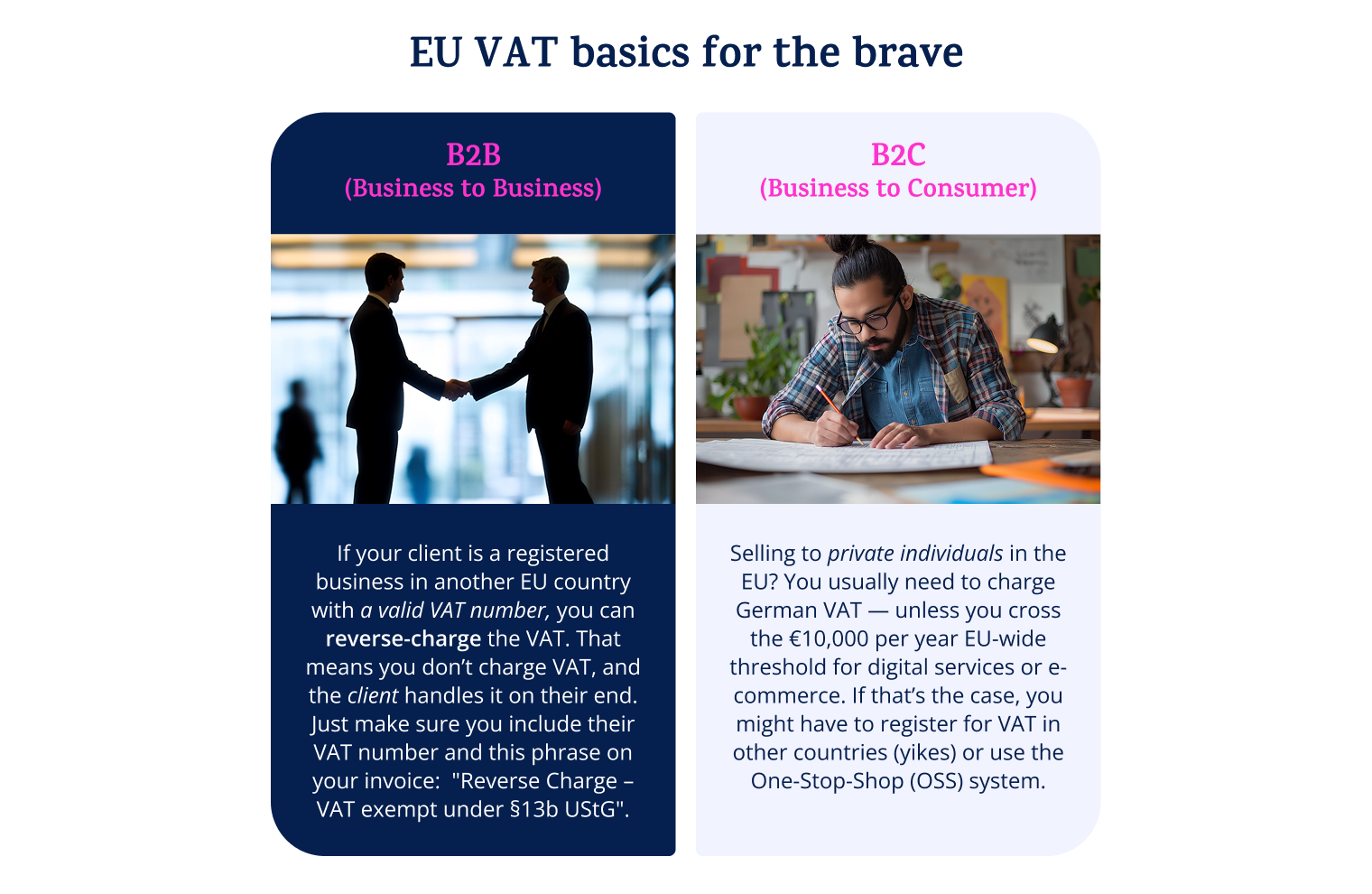

Working with clients in other EU countries? Welcome to EU VAT, where things get a bit trickier.

Bottom line:

- Freelancing for businesses? Reverse charge is your friend.

- Selling to consumers? Double-check your EU VAT rules or ask a tax pro. Because, yes, your invoices sometimes need a passport.

‘Kleinunternehmerregelung’: Small biz savior or tax trap?

The Kleinunternehmerregelung lets small businesses skip VAT if they:

- Earned under €22,000 in the last tax year

- Expect to earn under €50,000 in the current tax year

Here are good reasons for it:

- No VAT paperwork

- Simple invoices

- Ideal if you're just getting started

Here’s why you should reconsider:

- You can’t reclaim VAT on your purchases

- It might look less “official” to corporate clients

What to declare (and what happens if you don’t)

Tax declaration is no time to joke around. Everything you earn counts. That includes:

- Client invoices

- Income through freelance platforms (Etsy, Upwork, Fiverr, etc.)

- Payments for services, lessons and gigs

Even if you have a day job, you can absolutely freelance. Just make sure to report all income in your tax return. It’s not shady — it’s smart (and legal).

Income tracking basics for the brave and independent:

- Keep records of every invoice and receipt (How about a fancy dinner with clients?)

- Use a spreadsheet, app or accounting software

- And seriously… check your mailbox. The Finanzamt will write to you — and ignoring them is not a good life strategy.

Unexpected wins: Weird things you can deduct

Yes, the German tax system can feel like a maze with a few hidden delightful surprises. Here are some legit (and slightly weird) things that can be deducted:

- That €10 IKEA chair from eBay – If you sit on it while working (and not gaming), it’s technically business equipment.

- Your WiFi bill as a “study tool” – Especially if you're a student or freelancer. Just don’t try to write off Netflix.

- Printer paper, pens, highlighters, etc. – Basically, your entire stationery addiction. Welcome to Absetzbar-land.

- Part of your rent – Got a dedicated home office room? You can deduct it (no, your kitchen table doesn’t count). Don’t have one? There’s a €6/day flat rate, maxing at €1,260/year, even without a separate room.

- Books and courses – Self-development pays off (also on your tax return).

- Client coffees and networking lunches – Talk business? Deduct it. Talk gossip? Probably not.

Deadlines, fines and other thrilling plot twists

German taxes may not win an Oscar for their entertainment value, but the drama if you miss a deadline? Impeccable.

Filing deadlines for mere mortals

- If you're filing on your own (no tax advisor), your income tax return (Einkommensteuererklärung) is due by July 31 of the following tax year.

So, for 2025 income the deadline would be July 31, 2026. - Working with a Steuerberater (tax advisor)? Lucky you. You automatically get until the end of February of the following year.

How to get an extension like a boss (Yes, it is possible!)

Missed the deadline? It happens.

You can sometimes request a short extension. Just contact your local Finanzamt early and politely. Bonus points if you grovel a little.

What happens if you ghost the tax office

The Finanzamt doesn’t take ghosting well. Forget your deadline, and you may get:

- A reminder letter (friendly-ish)

- A late filing penalty: €25 per month late

- Estimation drama: They guess your income, and they’re typically not generous

- Possible late payment interest if you owe money

Lesson: respond to their love letters. Every. Time.

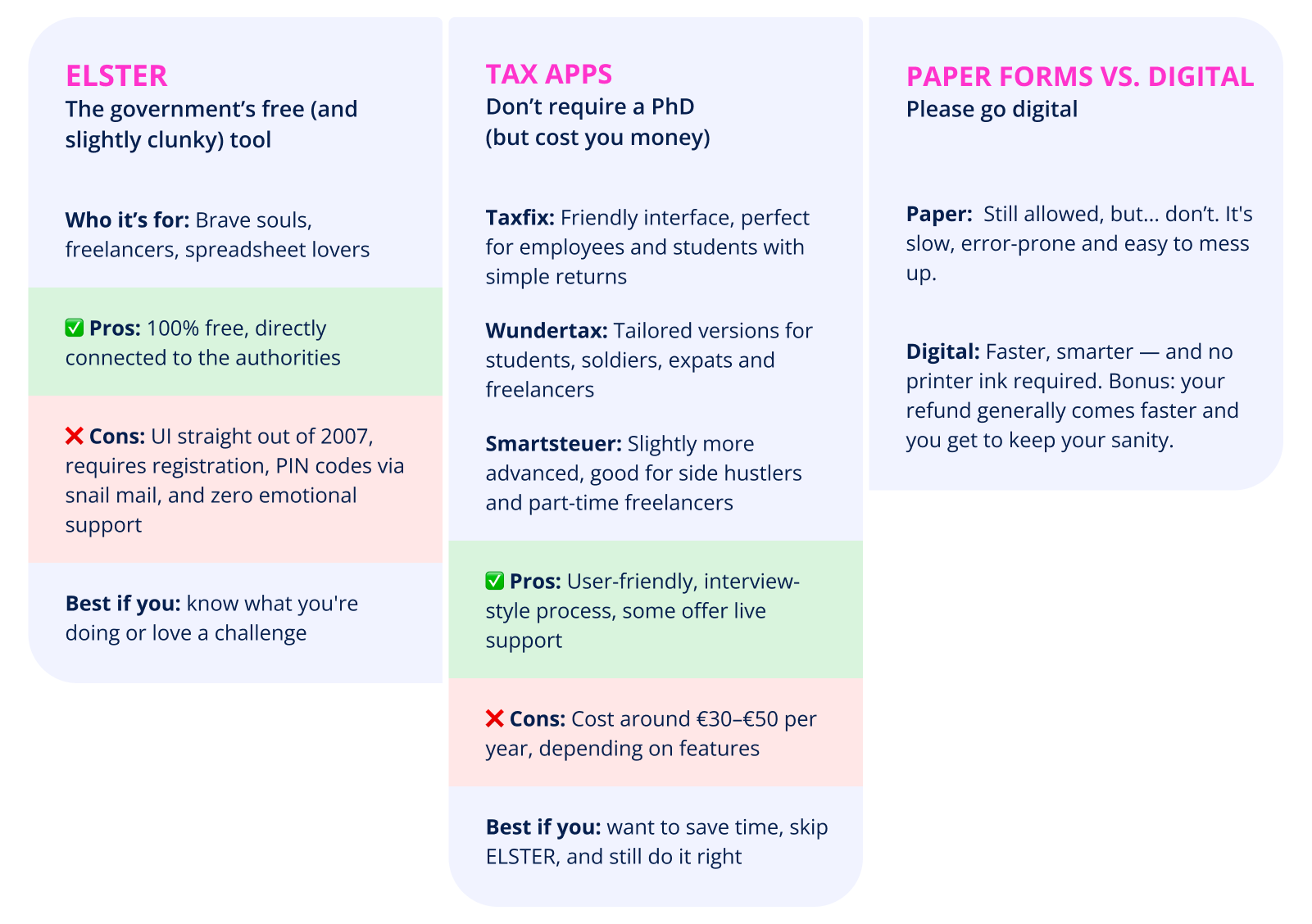

Tools that make this less painful

Filing taxes in Germany can feel like assembling IKEA furniture in the dark. These tools? They're your flashlight.

You made it through tax talk, and you’re still alive!

Filing your taxes is adulting. Getting a refund is winning.

If you’ve read this far, congratulations. You’ve just survived one of Germany’s most confusing systems without crying into a stack of paperwork. That’s peak adulting.

Sure, the tax system here is full of strange words, nested forms and paperwork that arrives by post. But once you get the hang of it (and maybe a refund or two), it’s not that scary.

TL;DR: German taxes aren’t evil. They’re just... very German.

They love their rules. They love their forms. And they really love precision. But they can be surprisingly generous. Especially if you know where to look for deductions, refunds and smart filing tricks.

Take a deep breath, bookmark this guide and mark that deadline in your calendar. You got this.

See you on the refund side!